FIN2002- Corporate Finance

ASSIGNMENT- Semester 2 2024

GENERAL GUIDELINES

• The assignment is due to be submitted by 11.59 PM on Friday, 11 October, via the LMS submission link.

• Both the report (Word file) and relevant calculations (Excel file) must be submitted. The marking is based on your report, so you must include all of your outcomes and tables from the Excel file in the report. The Excel file is used to check your work only.

• This assignment will contribute 30% towards the subject’s total assessment.

• Maximum 1500 words (excluding Tables, References, and appendices)

• Your allocated company is as below:

1. If your student ID ends with 0 or 1, your assigned company is Santos Limited (STO)

2. If your student ID ends with 2 or 3, your assigned company is AGL Energy Limited (AGL)

3. If your student ID ends with 4 or 5, your assigned company is JB Hi-FiLtd (JBH)

4. If your student ID ends with 6 or 7, your assigned company is TPG Telecom Ltd (TPG)

5. If your student ID ends with 8 or 9, your assigned company is EBOS Group Limited (EBO)

• Please carefully read the required tasks and instructions below.

REQUIRED TASKS

This assignment requires the completion of the following tasks:

a) Provide an overview of your company (i.e., business nature, industry, size, growth rate, and how long it has been in operation) (up to 300 words). (2 marks)

b) Calculate Long-term debt/Total assets and Long-term debt/Equity ratios for the company allocated to you over the five years 2019 to 2023. (4 marks)

c) Compare your firm’s long-term debt/total assets and long-term debt/equity ratios with your firm’s industry average and discuss the findings. You can choose any industry classification level (sector/industry group/industry) and make sure you have at least ten companies other than the company allocated to you for industry comparison. (4 marks)

d) Identify a matching firm in your firm代 写FIN2002- Corporate Finance ’s industry that is similar in size to your firm (use 2023 total assets to choose a matching firm) . Compare your firm’s long-term debt/total assets and long-term debt/equity ratio with your matching firm and discuss the findings. (4 marks)

e) Briefly discuss the term “Optimal Capital Structure” . Does your company have an optimal debt/equity ratio? Use calculations on business risk in your analysis. (Hint: standard deviation of EBIT/Total Assets over five years 2019-2023: use the template for calculation in the LMS). Justify your answer and include citations and references. (4 marks)

f) Identify one dividend change (interim or final) announcement (note: compare interim to interim to identify changes in interim dividend or final to final to identify changes in final dividend using “dividend history from the DatAnalysis Premium Database” for the company allocated to you). Identify the interim announcement date from the half-yearly report or final announcement date from the preliminary final report

(i) Calculate (2 marks)

• The three-day return earned by your firm for the period from the day before the announcement day to the day after the announcement date

• The two-day return earned by your firm for the period from the day of the announcement to the day after the announcement date

(ii) Calculate the market return for the corresponding periods in (i). (1 mark)

(iii) Calculate the excess return: (i) - (ii) (1 mark)

g) Compare and discuss the relevant theory for the findings of the market reaction to dividend changes in (f(iii)). In your discussion, include the signaling hypothesis, the free cash flow hypothesis, and the clientele hypothesis. Include citations and references. (6 marks)

h) Presentation of the report (format and layout; inclusion of graphs to show the trend), citation and references. The report should be formatted in a professional manner: using Times New Roman font at size 12 and double-spacing for the main text and single-spacing for others (tables, figures, appendices, etc.). All figures and graphs must be clearly labelled and numbered. References and citations follow either the AGPS Harvard Style. or APA style. (2 marks)

INSTRUCTIONS

Step 1

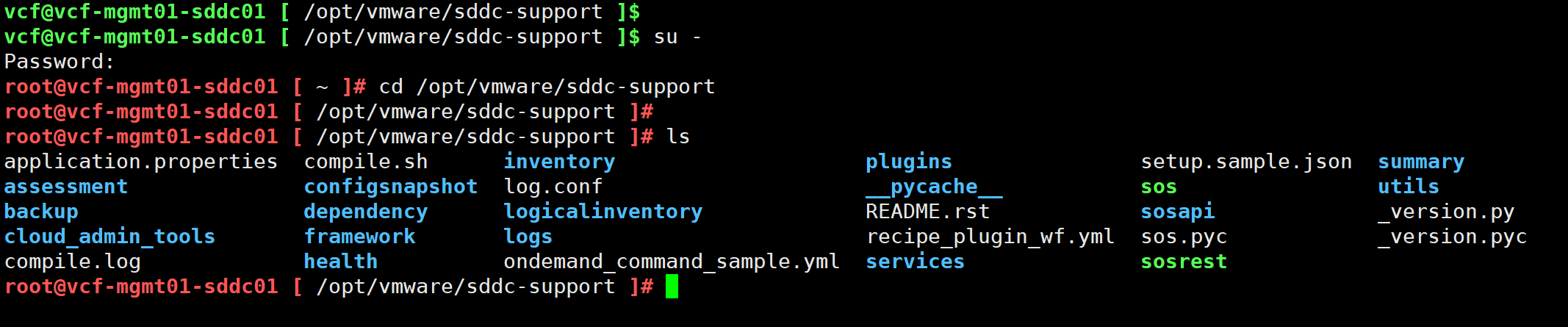

Log on into DatAnalysis Premium at http://www.lib.latrobe.edu.au/databases/title.php?l=D

Step 2

a) Click on the Company Reports tab. Enter your company’s three letter ASX code. Choose

the required company from the list of options which match your entry.

b) Click on Financial Data tab that appears on the left-hand side.

c) Data on “Total Equity”, “Long-term Debt” and “Total Assets” can be found under the Balance Sheet tab.

d) Data on “EBIT” can be found under the Profit & Losstab.

e) Adjust Year Range to customize for the required period. Click GO. Click Download Spreadsheet to download required data into an Excel document.

f) Use downloaded data to calculate “Long term Debt / Total Assets” and “Long term Debt / Equity” ratios.

Step 3

a) Information on your company’s industry, including GICS Sector, GICS Industry Group and GICS Industry, can be found under Corporate Details tab. Note this information down for the next step.

b) Click on Search Tool tab that is next to the Company Reports tab. Select Time-Series Financial Search from the drop-down menu.

c) In Section A, tick All Companies. Adjust Year Range for the five-year period. Group by

Data Item. Use information that you identified in the step 2a to select GICS Section, GICS Industry Group and GICS Industry from drop-down menus.

d) In Section B, select Annual Balance Sheet from the drop-down menu under Section.

Select “Total Equity”, “Long-term Debt” and “Total Assets” with the option Display

Only and click ‘Add Query’ . Your search criteria will then be added to the ‘ Query List’ box in Section C.

e) Click Search to display search results. Click Download Spreadsheet to download the search results into an Excel Spreadsheet

f) Use downloaded data to calculate “Long term Debt / Total Assets” and “Long term Debt / Equity” ratios for all companies in the identified industry. Then calculate industry average for these ratios.

Please look at the “Guidance for computing the industry average” file on the LMS for additional guidance.

Step 4

You can use the average of your firm’s industry average ratios as “optimal capital structure”.

You can also calculate business risk of your allocated company (standard deviation of

EBIT/Total assets for the 5-year period) as well as other firms in your firm’s industry. Use the “Template for Calculation” in the LMS to calculate business risk, industry average etc.

a) A dividend change is defined as the relative difference from the previous year’s level.

• Interim dividend change = interim dividend per share in year t minus interim dividend per share in year t-1.

• Final dividend change = Final dividend per share in year t minus Final dividend per share in year t-1.

b) Announcement date for the dividend change can be identified from “ASX announcements from the DatAnalysis Premium Database ”.

• Announcement date for interim dividend change: use the announcement date of half yearly report

• Announcement date for final dividend change: use the announcement date of preliminary final report

Select “ASX announcements”

Select “ Search option - Click here to refine your search by ASX Announcement Type and/or text search”

For Announcement Type: select periodic reports

For Sub-Announcement Type: select preliminary - final statement for final dividend; half yearly report interim dividend change

Specify the date range

c) The stock prices required for calculating stock returns are available from Yahoo Finance.