MATH GR5280, Capital Markets & Investments

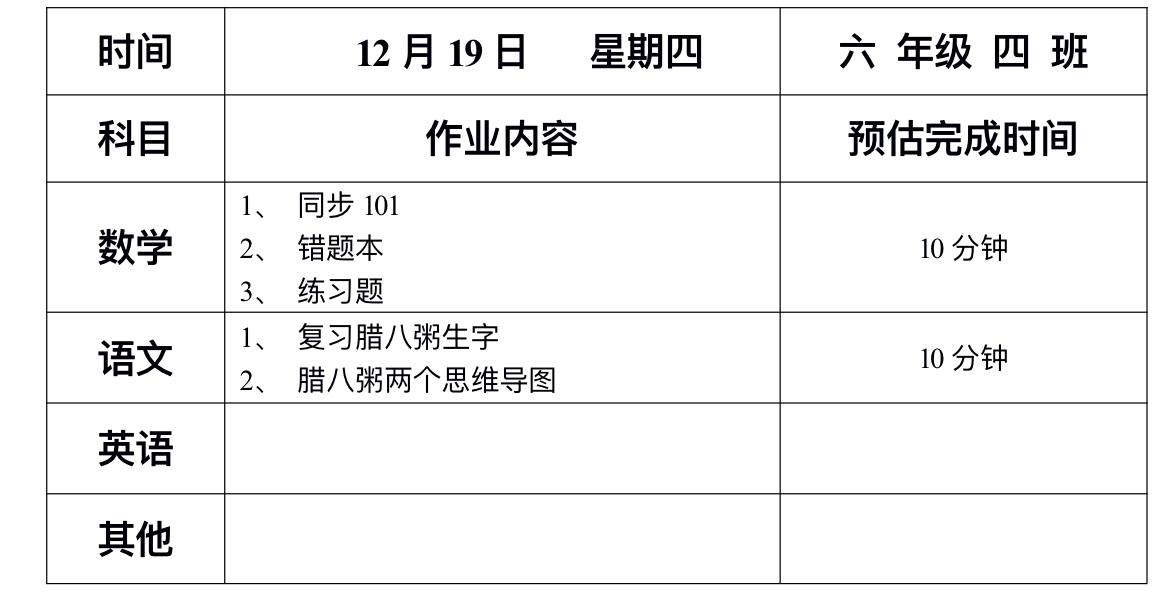

Start date: 12/7/2024 Due date: 12/21/2024

1Final Project

Note: All files and information related to the final project are uploaded into the Modules starting with “Final Project” prefix on CourseWorks. The aim of this Final Project is to practically implement the ideas from the course, specifically fromChapters 7 and 8 of [BKM13]. Using Bloomberg, you will be given a recent 20 years of recent historicaldaily total return data for ten stocks, which belong in groups tothree-four different sectors (according toYahoo!finance), one (S&P 500) equity index and a proxy for risk-free rate (1-month Fed Funds rate).Additionally, you will be given contemporaneous ESG [ESG3] scores data also from Bloomberg for allof your companies with detailed explanations to them. In order to reduce the non-Gaussian effects, youwill need to aggregate the daily data to the monthly observations, and based on those monthlyobservations, you will need to calculate all proper optimization inputs for the full Markowitz Model(“MM”), alongside the Index Model (“IM”). Using these optimization inputs for MM and IM you willneed to find the regions of permissible portfolios (efficient frontier, minimal risk portfolio, optimalportfolio, and minimal return portfolios frontier) for the following four cases of problems:

- This optimization is designed to simulate the typical limitations existing in the U.S. mutual fundindustry: a U.S. open-ended mutual fund is not allowed to have any short positions, for details seethe Investment Company Act of 1940, Section 12(a)(3)

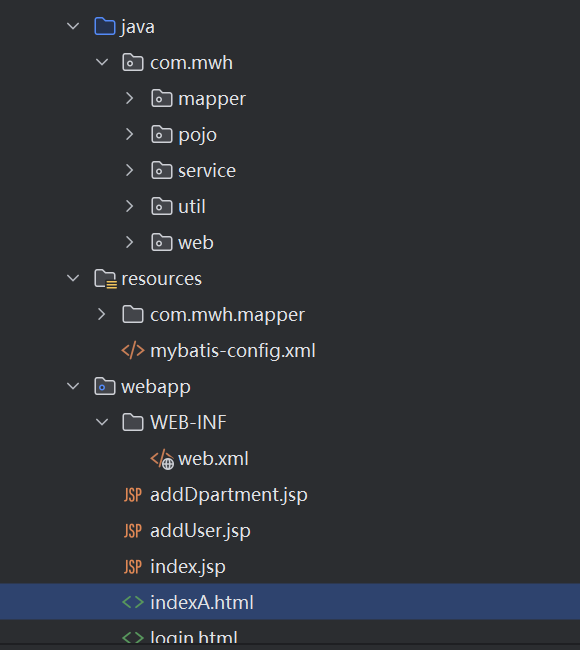

(https://www.law.cornell.edu/uscode/text/15/80a-12):i ≥ for ,0 ∀iw ;Now, having the efficient risky portfolioYou will need to numerically solve the above problems using the template “FinalProject AlexeiChekhlovGroup0.xlsx” and submit your numerical solutions as such file, with filename adjusted with your

“FinalProject FirstnameLastname Group(your group#).xlsx”. Please, do not insert or delete any cells, keepthe existing format – it is very nicely done and the graphs will allow you to “see” your solutions. The areasof cells that you will need to fill-in with your numerical solutions are as follows. The points for MM: MATH GR5280, Capital Markets & Investments

Start date: 12/7/2024 Due date: 12/21/2024 2P2:AC3, P5:AC6, P8:AC9, P11:AC12. The curves (frontiers) for MM: C33:F113, I33:L113, O33:R153.The points for IM: AI2:AV3, AI5:AV6, AI8:AV9, AI11:AV12. The curves (frontiers) for IM:AM33:AP113, AS33:AV113, AY33:BB153. The grading will be done by comparing your tabulated

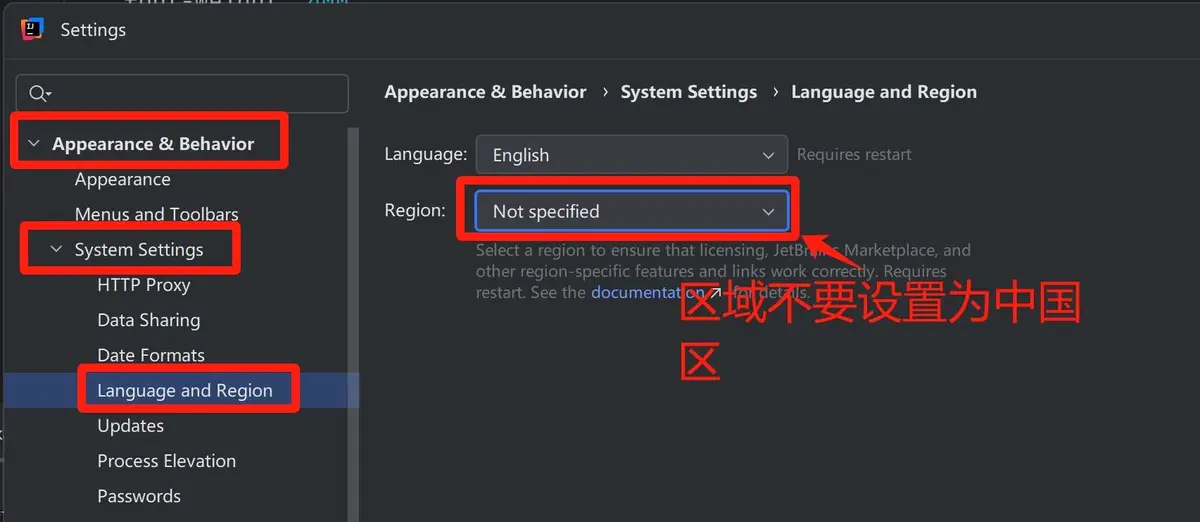

results to exact solutions. The calculations should be done on a Windows computer with licensedMicrosoft Office installed.Again, you will be given 20 years of daily data of total returns for the S&P 500 index (ticker symbol

“SPX”), and for ten stocks (ticker symbols see the table below) such that there are three-four sectors ostocks with stocks in each group belonging to one (Yahoo!finance) sector and an instrument representingrisk-free rate, 1-month annual Fed Funds rate (ticker symbol “FEDL01”). Note that stocks in each groupare completely different. Therefore, each group will have its own results and conclusions.Below, please, find the table of stock ticker symbols (aka, tickers) for each group to work with:

10 MCD McDonald's Corporation Consumer CyclicalMATH GR5280, Capital Markets & Investments Start date: 12/7/2024 Due date: 12/21/2024 4Using this data and the template Excel spreadsheet you will need to make all the necessary calculations toproduce the Permissible Portfolios Region, which combines the Efficient Frontier, the Minimal Risk or Variance Frontier, and the Minimal 代写MATH GR5280, Capital Markets & Investments Return Frontier for a given set of constraints (1-4 above). TheMinimal Return Frontier and the Efficient Frontier together are forming the Minimal Risk or Variance Frontier – it is just a matter of reformulating the optimization problem, as follows:Minimal Risk or Variance Frontier:i in each case corresponds to the efficient risky portfolio solution of the corresponding nonESG-constrained problem.As we have already mentioned, your task is to produce the following objects on the Permissible PortfoliosRegion in the numerical (and the template spreadsheet does it in the graphical for you) form:

- Minimal Risk or Variance Frontier (a curve), range for portfolio returns: from -10% to 50% withstep of 0.5%;

- Global Minimal Risk or Variance Portfolio (a point);

- Maximal Sharpe Ratio or Efficient Risky Portfolio (a point);

- Maximal Return or Efficient Frontier (a curve), range for portfolio standard deviation: from 10%o 50% with step of 0.5%;

- Capital Allocation Line or CAL (a straight line);

- Minimal Return or Inefficient Frontier (a curve), range for portfolio standard deviation: from 10%to 50% with step of 0.5%.The curves above must be produced in tabular form (Excel), using the template provided, preserving theformats in the template, with which comparison to exact solution will be made for grading, usingspecifically the above ranges. If a numerical solution cannot be found, just leave the corresponding cellempty. The points above should also be tabulated. All the tabulation should be done similar to exampleprovided by the Instructor (see the file “Final Project Group0.xlsx” provided). MATH GR5280, Capital Markets & Investments Start date: 12/7/2024 Due date: 12/21/2024 Do not hesitate to ask TAs, Lecturer any questions.You are given two weeks to complete the Final Project and to submit the work in the form of .xlsx filethrough the portal. We encourage you not to delay starting the work as workload is meant for several daysof work and not as a one-night effort.